October market crashes—such as those in 1929 and 1987—give the month a bad rap. But what about the many, many times October didn’t result in a big, bad downturn? A great example is October 1998, which wasn’t a meltdown, but a melt up, if you will. And it came on the heels of a host of fears and scary events that had been troubling markets.

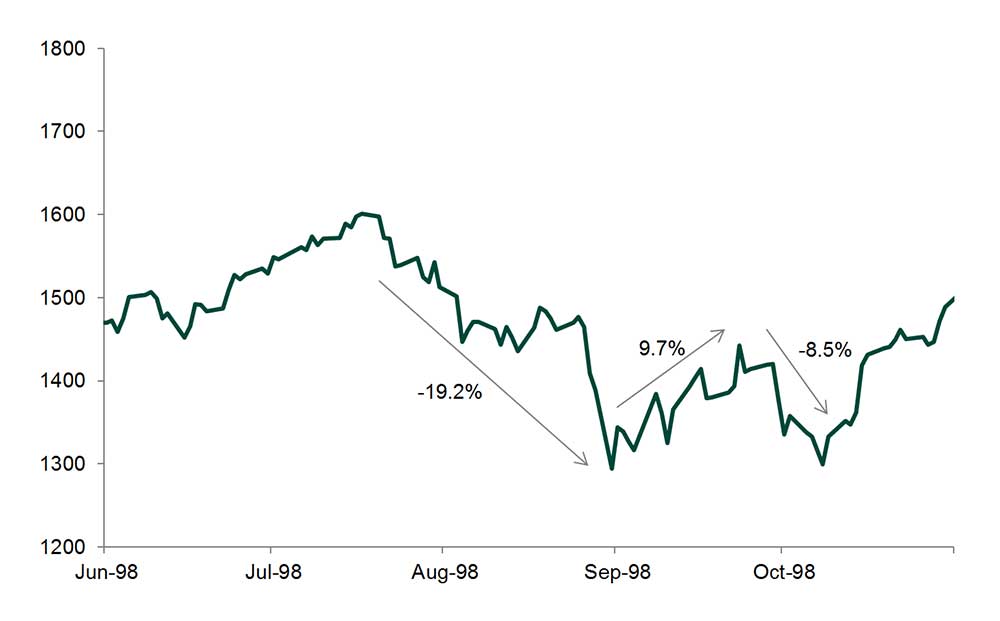

In 1997, many Southeast Asian countries were facing financial crises that took a toll on their currencies and their ability to make payments on foreign-denominated debt. As fears lingered, oil prices began falling and other emerging markets struggled as well. In August 1998, Russia defaulted on some of its debt. From July 17 to August 31, the S&P 500 Index fell 19.2%.[i] After rallying through much of September, stocks retreated again when hedge fund Long-Term Capital Management—which had significant exposure to Russian debt—failed and required a bailout. By October 8, the S&P 500 Index had nearly reached its previous month’s low. Given all the market uncertainty, some believed a global recession would lead to a longer downturn. However, stocks actually rose 11.5% in October 1998, as Russia’s economy began to recover and Long-Term Capital Management’s bailout deal seemed to ward off fears of further market trouble.[ii]

Source: Global Financial Data, as of 10/09/2019. S&P 500 Index total return, 06/01/1998 – 10/31/1998.

Corrections, sentiment-driven drops of roughly 10% - 20%, can come and go quickly and without warning. Reacting to steep, sudden drops can hurt your long-term returns if you end up selling when stocks are down and missing a rebound like October 1998’s. While it’s easy to point to a couple spooky Octobers, there are plenty of counterexamples—like this one—that contributed to stocks’ long-term growth.